This is a question that continuously pop-up in conversations. In this post, we will ponder on this question.

If we rewind ten years to where I was talking to a group of final year university students about the possibility to explore a career in the Profession of Financial Planning my conversation would look a lot different to today. I would have shared that we bring together the world of Accounting (Cashflows, Taxes and Numbers) and the world of Law (Buy and sell agreements, Contracts and Wills) as Financial Planners for our clients to support them living their best lives possible. We ensure integration for our clients to see the bigger picture and have peace of mind by mitigating and managing their risks.

Having that same conversation in 2022, I now know that each client we engage with is a unique human being, with a unique personality, with something special that creates meaning and purpose for them. As our clients live in an ever-changing ecosystem where money is one of the resources on their journey. We still bring integration; however, we are their thinking partners as we create awareness and help them unlock meaning and take accountability for their lives.

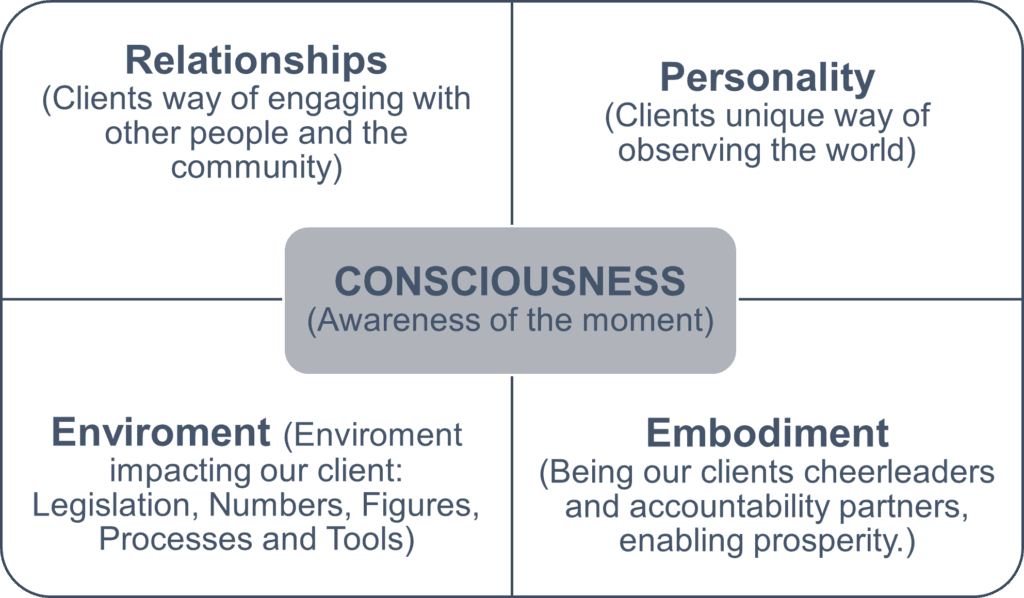

As financial coaches, we bring together the following interrelated parts of our clients’ lives to support our clients to become and sustain prosperity and live meaningful lives:

We, as financial coaches, are curious to understand these interrelated parts and explore, with our client’s permission, how it influences their quality of life and supports them to achieve what is important for them.

Consciousness: As Purpose-Driven Financial Coaches, we want to continue improving our ability to be present in the moment and observe our way of being and that of our clients. We do this using the ontological philosophy of observing Language (Listening, Questioning and Speaking), Moods and Body.

Personality: As financial coaches, we want to understand our clients’ unique personalities, communication styles, values, and dreams. We want to observe what creates meaning for our clients. Although we, as coaches, are not psychologists, we can draw on some of the research and practices of psychology. As it can supply us with a better understanding of our clients as human beings and how we can be their thinking partners on their journey to financial and personal wellness.

Relationships: Our clients do not live in isolation. They are born and grow up in households and communities that influence their language, cultures and belief systems. As our clients go to school and later further their studies, formally or informally, they form social networks that further influence the abovementioned factors. Then they start to work which leads to additional social networks and influences. This cycle continues, adapt and changes as our clients’ create new relations and discover new incites. As financial coaches, we want to observe what creates belonging and influences our clients’ way of observing the world. We can draw from sociology to better understand these dynamics.

Environment: As financial planners, potentially this part of our engagement with our clients comes most naturally as this is home for us. We offer our clients advice and solutions through our understanding and analysing of the numbers. The understanding needed for this part is already a daunting task as we need to consider the world of accounting (Tax and Numbers) and law (Contracts). In this domain, influential or changing, factors to the client’s environment include retrenchment, reallocation, or markets corrections, as a few examples.

Embodiment: As financial coaches, we want to have quality relationships and conversations with our clients to enable them to change how they observe the world, to allow them to adopt a new language, moods and processes that will support them on their journey to financial prosperity. We act as cheerleaders and accountability partners as part of our role as financial coaches. In this capacity, we also have conversations with our clients which ensure the successful execution of agreed outcomes.

Can we then say we dance the above integration dance with our clients as they navigate through the natural life cycle and experience multiple life transitions?

What is the answer, then?

This leaves me with some personal questions:

- What changes if I embody a new way of being as a planner, and\or as a financial coach?

- How does this new way of being, influence my advice process?

- What will serve my clients and me best; Wearing two hats, that of coach and planner, or an integrated approach of a coaching way to financial planning?